As we are now nicely into 2024, it's certain the Northampton housing market over the last 18 months has been a little more restrained than 2020, 2021 and early 2022, and I believe that the ‘steady as she goes’ outlook will continue into the rest of 2024 and beyond.

As property ownership is a medium to long-term investment, it is important to see what has happened to Northampton house prices.

Since the start of

the Millennium (Jan 2001), the average Northampton homeowner has seen their

property’s value rise by an average of 173%.

This

is important as house prices are a national obsession and tied into the health

of the UK economy as a whole. Most of that gain has come from the overall growth

in Northampton property values, while some of it will have been enhanced by extending,

modernising or developing their Northampton home.

Taking

a look at the different types of property in Northampton and the profit made by

each type, it makes interesting reading:

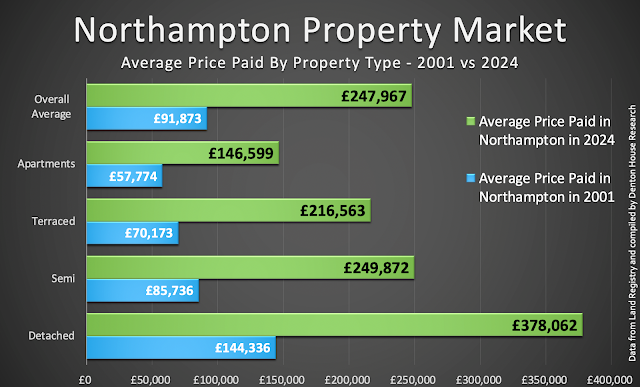

· Overall Average For All Homes in Northampton. The average price of all homes in Northampton in 2001 was £91,873. Now it's 2024, and it has risen to £247,967. This is a total profit of £156,094 (which is £6,787 profit per year per home or an annual growth of 7.5% per year).

· Apartments in Northampton. The average price of an apartment in Northampton in 2001 was £57,774. Now it's 2024, it has risen to £146,599. This is a total profit of £88,825 (which is £3,862 profit per year per home or an annual growth of 6.8% per year).

· Terraced/Town Houses in Northampton. The average price of a terraced/town house in Northampton in 2001 was £70,173. Now it's 2024, it has risen to £216,563. This is a total profit of £146,390 (which is £6,365 profit per year per home or an annual growth of 9.1% per year).

· Semi-Detached Homes in Northampton. The average price of a semi-detached home in Northampton in 2001 was £85,736. Now it's 2024, it has risen to £249,872. This is a total profit of £164,136 (which is £7,136 profit per year per home or an annual growth of 8.4% per year).

· Detached Homes in Northampton. The average price of a detached home in Northampton

in 2001 was £144,336. Now it's 2024, it has risen to £378,062. This is a total

profit of £233,726 (which is £10,162 profit per year per home or an annual

growth of 7.0% per year).

However, we can’t forget there has been 79% inflation over

those 23 years, which eats into the ‘real’ value (or true spending power of

that profit) … so if we take into account inflation since 2001, the true ‘spending

power’ of that profit has been lower.

· Overall Average For All Homes in Northampton. The total 'real profit' (i.e., after inflation has been removed) for the average Northampton home is £86,864 for the last 23 years. This equates to £3,777 'real' profit per annum.

· Northampton Apartments. The total 'real profit' (i.e., after inflation has been removed) for the average Northampton apartment is £49,430 for the last 23 years. This equates to £2,149 'real' profit per annum.

· Northampton Terraced/Town Houses. The total 'real profit' (i.e., after inflation has been removed) for the average Northampton terraced/town house is £81,464 for the last 23 years. This equates to £3,542 'real' profit per annum.

· Northampton Semi-Detached Homes. The total 'real profit' (i.e., after inflation has been removed) for the average Northampton semi-detached home is £91,339 for the last 23 years. This equates to £3,971 ‘real' profit per annum.

· Northampton Detached Homes. The total 'real profit' (i.e., after inflation has

been removed) for the average Northampton detached home is £130,065 for the

last 23 years. This equates to £5,655 'real' profit per annum.

Thus, the annual profit for an average Northampton home,

adjusted for inflation, stands at £3,777.

I wanted to

illustrate that despite the 2008/09 Credit Crunch property market crash, which

saw Northampton property values plummet by 15% to 20% over 18 months,

homeowners in Northampton have still fared better over the long term than those

renting.

Looking ahead,

a common question I get asked is about the future trajectory of the Northampton

property market.

The primary

influence on maintaining house price growth in Northampton over the medium to

long term will be the construction of new homes locally and nationally.

Although we have yet to get the figures for 2023, government sources indicate

that the number of new households is expected to be between 210,000 and 220,000.

Considering the annual need is for 300,000 new households to meet demands

arising from factors such as immigration, increased life expectancy, higher

divorce rates, and later cohabitation, it’s clear that demand will continue to

outstrip supply unless the government heavily invests in building council

houses.

This can only

be good news for Northampton homeowners.

What about Northampton landlords, though?

Even though the number of landlords liquidating their property portfolios has increased in the last couple of years and the number of landlords buying is lower than in the 2000s and 2010s, there is still net growth in the size of the private rented sector each year. This is all despite facing higher taxes. The simple fact is many Northampton landlords remain keen on expanding their portfolios in the long term.

The younger

generation in Northampton views renting as a choice that offers flexibility and

alternatives that homeownership does not provide. This means that demand for

rentals will keep growing, allowing landlords to enjoy rising rents and capital

appreciation. However, Northampton buy-to-let landlords must adopt more

thoughtful strategies to maintain profitable returns from their investments.

As a Northampton

buy-to-let landlord, the question for you is how to ensure this growth

continues.

Since the

1990s, generating profits from buy-to-let property investments was

straightforward. Moving forward, with changes in the tax laws and the balance

of power, achieving similar returns will be more effortful. Over the past

decade, I've observed the evolution of agents from mere rent collectors to

strategic portfolio managers. I, along with a select few agents in Northampton,

am adept at providing comprehensive, strategic portfolio leadership. This

service offers a structured overview of your investment goals across short,

medium and long-term horizons, focusing on your expected returns, yields and

capital growth. If you seek such advice, feel free to contact your current

agent or me directly at no cost or obligation.